Real Worries from Parents

With the development of internet, parents are now becoming more worried about their children's online safety in their common life. See what parents are saying in their real life.

With the development of internet, parents are now becoming more worried about their children's online safety in their common life. See what parents are saying in their real life.

.svg)

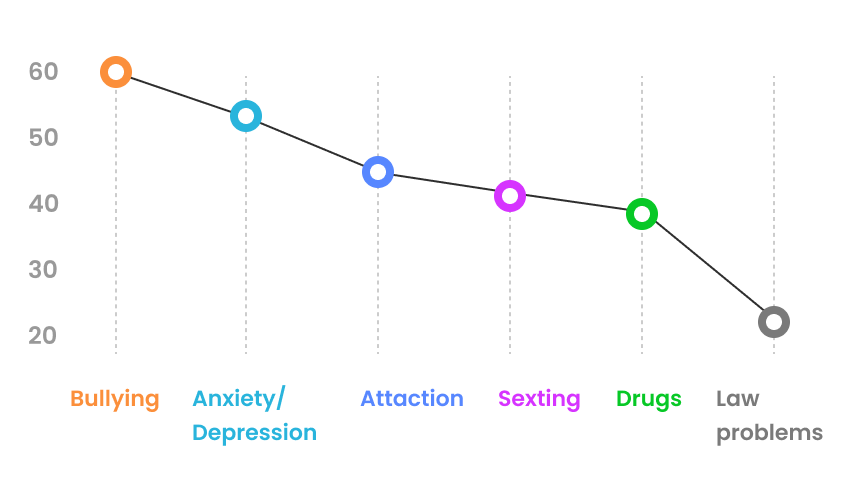

Parents today have different concerns about their children — anxiety, depression, suicidal ideation, bullying, breach of law and more.

Source: Survey of U.S. parents with children under 18

The internet poses risks, including encounters with online predators and exposure to inappropriate content.

.svg)

Cyberbullying, traditional bullying and improper relationships remain significant problems among kids and teenagers.

.svg)

Teens are unaware of their digital footprint and the potential consequences of sharing personal information online.

.svg)

Children's daily life can be numerously interfered with the addiction to playing various online games.

.svg)

Teens like to share their moments on various social media apps and become more addicted to them.

High expectations, numerous test and homework overload may put your children to play truant.

With various apps and contents appearing on the internet, let's see what your kids are liking.

The Best parental control app

Protect Your Loved Ones and Keep Your Children Safe!

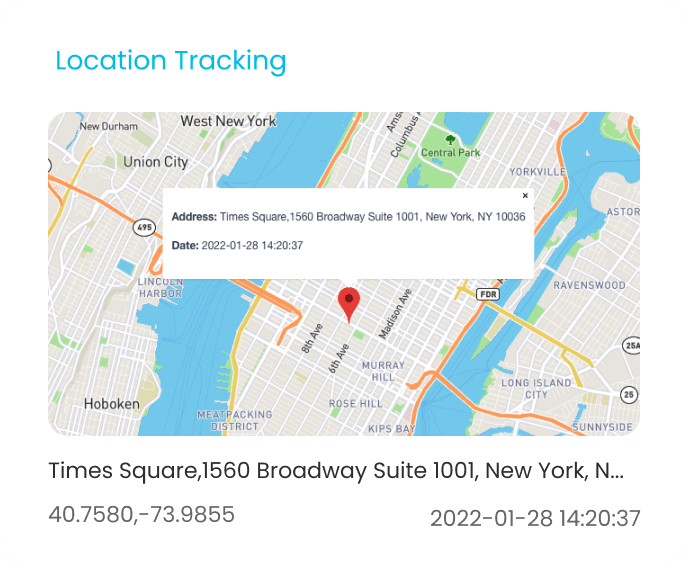

Location

Location

Track your children's real-time location and set up geofence for them to prevent truancy

and the like.

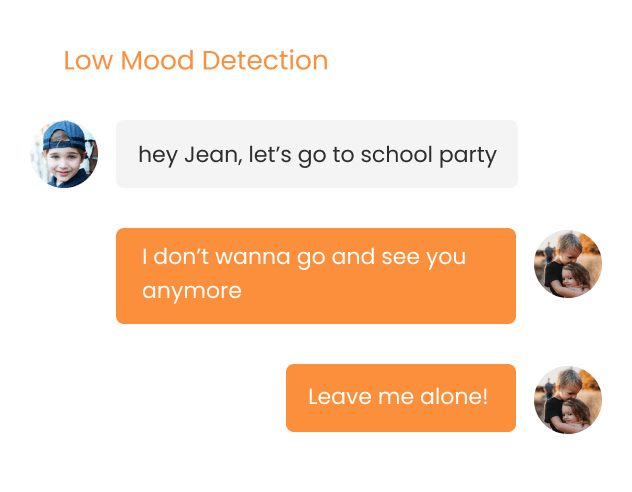

Low Mood Detection

Low Mood Detection

Monitor contents and keylogger to reduce your children's depression, anxiety, peer

pressure, etc.

.png)

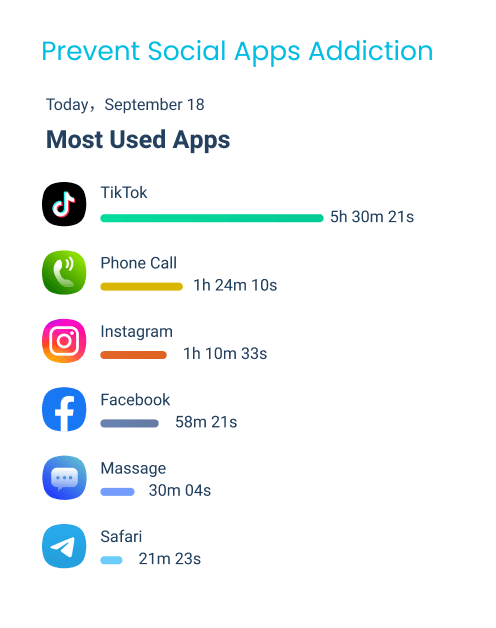

Prevent Social Apps Addiction

Prevent Social Apps Addiction

Monitor various social apps activities like WhatsApp, Instagram, Discord, KiK and more

to ensure your kids don't get addicted to social media and gaming apps.

.png)

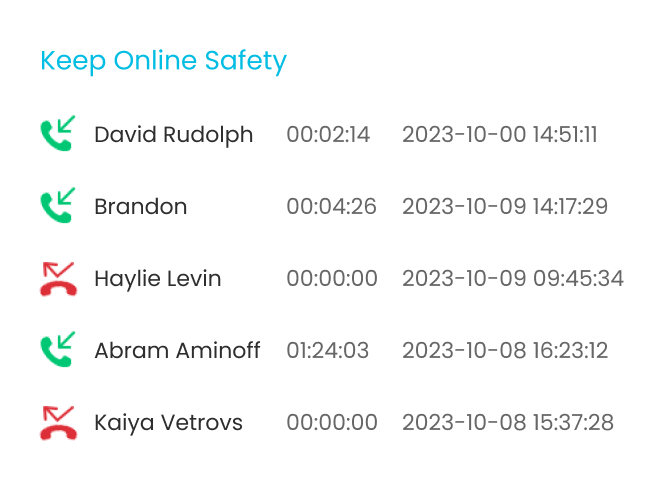

Keep Online

Keep Online

Let you see messages, contacts, call logs and remotely record their calls to catch

unsafe behavior such as cyberbullying and self-harm immediately.

.png)

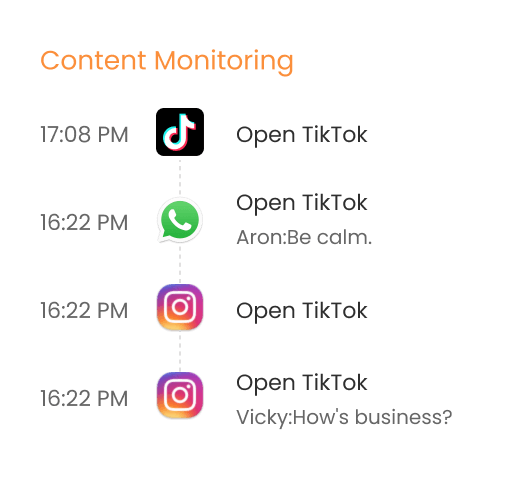

Content

Content

Allow parents to check your kids' browser history and social media contents to prevent

them from seeing improper contents.

.png)

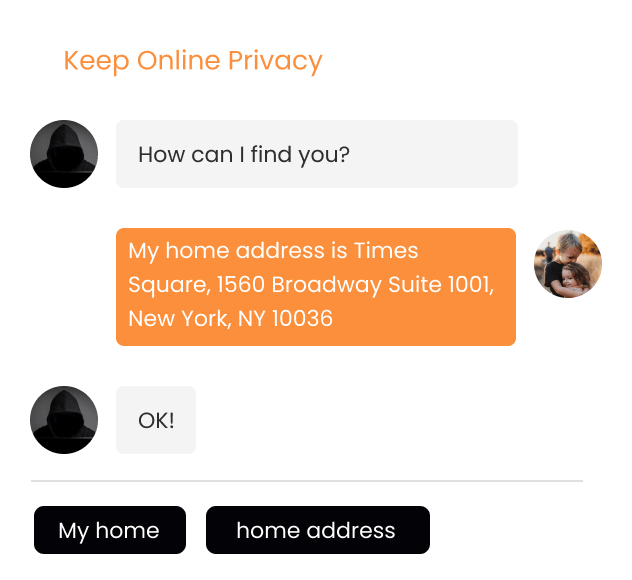

.svg) Keep Online Privacy

Keep Online Privacy

Track your kids' online keywords and receive notifications to ensure they won't share

privacy with strangers.

KidsGuard Pro parental control software helps with your concerns and reduces the risks your kids face online, whatever their age and needs.

“I’ve been using KidsGuard Pro with my own kids for several years because I’m allowed to check and be alerted for anything inappropriate or other things of concern.“

According to a recent research, 70% of children aged 7-17 always encounter pornographic content through online searches; 35 % of adults are having cybersex or online affairs even if they are in relationship. Perhaps, because of all these facts, we’ve seen many people are looking for the apps to monitor Android phones.

Review link >>

KidsGuard Pro covers a wide range of features, including parental control, iPhone parental controls, phone tracker, phone spy, and Whatsapp hack. Parents can monitor various types of data on their child’s smartphone, including contacts, call history, browsing history, calendar events, text messages, photos, and videos. Even deleted data on the target device can still be accessed with KidsGuard Pro.

Review link >>

In today's digital age, children are exposed to a vast amount of online content, making it crucial for parents to have effective parental control measures in place. With the rise of smartphones and tablets, it has become increasingly important to monitor and manage your child's online activities. Thankfully, there are several reliable parental control apps available, such as KidsGuard Pro.

Review link >>

In this comprehensive Kidsguard Pro review, we provide detailed insights into its features, how it works, and the pros and cons of this phone tracker. Our goal is to help you make an informed decision about whether or not this program meets your surveillance needs.

Review link >>

I’m Milica Courtney, a tech enthusiast who has extensively reviewed phones, laptops, PCs, and various apps. Recently, I delved into cell phone spy apps, comparing major players like Cocospy, KidsGuard, FlexiSpy, Spyic, and more. Among them, KidsGuard Pro stood out as a top-notch solution for digital parenting, boasting advanced AI features that set it apart from the rest. With its exceptional AI-powered capabilities, swift data updates, comprehensive data coverage, and budget-friendly pricing, KidsGuard Pro has earned my trust and admiration.

Review link >>

Try KidsGuard Pro to keep your kids safe!